PalmCredit Loan App: A Comprehensive Guide to Hassle-free Personal Loans.

In today’s fast-paced world, financial emergencies can arise at any moment, leaving us in need of immediate funds. Whether it’s for medical expenses, home repairs, or unexpected bills, personal loans can be a lifesaver in such situations. One such convenient and hassle-free loan provider is PalmCredit Loan.

What is PalmCredit?

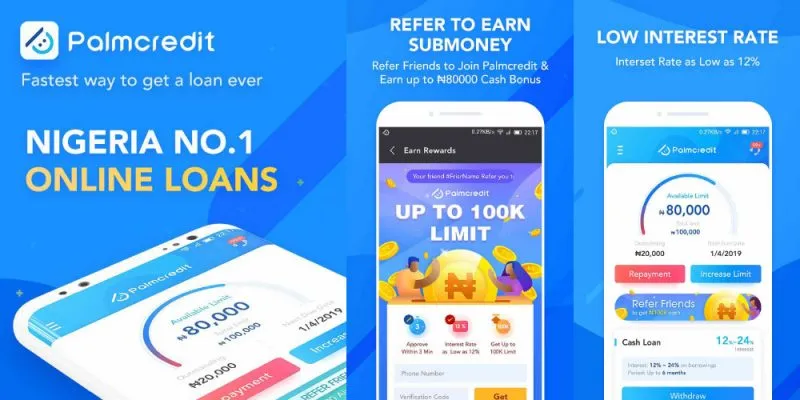

PalmCredit is a leading online loan provider that aims to make personal loans easily accessible and hassle-free for individuals. With its user-friendly platform and efficient loan application process, PalmCredit has gained popularity among borrowers seeking quick financial assistance.

How does PalmCredit Loan App work?

The process of obtaining a PalmCredit Loan is simple and straightforward. By leveraging advanced technology, the PalmCredit loan app eliminates the need for lengthy paperwork and physical visits to a traditional lender. The entire loan application process can be completed right from the comfort of your own home.

Pros and cons of PalmCredit Loan App

Like any financial product, PalmCredit Loan has its own set of advantages and disadvantages. Understanding these can help you make an informed decision before opting for this loan provider. Here are some pros and cons to consider:

Pros:

- Quick and convenient loan approval process.

- No collateral or guarantor is required.

- Flexible repayment terms.

- Easy-to-use mobile application.

- Transparent fees and interest rates.

Cons:

- Relatively higher interest rates compared to traditional lenders.

- Limited loan amounts for first-time borrowers.

- Late payment penalties can be steep.

Benefits of Choosing PalmCredit Loan App

By opting for a PalmCredit Loan, you can enjoy a range of benefits that make it an attractive option for individuals in need of quick cash. Some notable benefits include:

- Fast approval and disbursal process.

- No need for collateral or guarantors.

- Convenient repayment options.

- Flexibility to choose loan amounts and repayment terms.

- Accessible via a user-friendly mobile application.

Read Also: PiggyVest Login – Save with PiggyVest

Features of PalmCredit Loan App

PalmCredit Loan app offers several features that cater to the unique needs of borrowers. It’s important to understand these features to make the most of your loan experience. Key features include:

- Instant loan approval.

- Flexible loan amounts.

- Repayment terms tailored to your preferences.

- Transparent fees and interest rates.

- Convenient mobile application for loan management.

Loan amounts and repayment terms: PalmCredit Loan app provides borrowers with the flexibility to choose loan amounts that suit their requirements. Depending on your creditworthiness and borrowing history, you can access varying loan amounts. Additionally, PalmCredit offers flexible repayment terms, allowing you to repay the loan in installments that align with your financial capabilities.

Interest rates and fees: While PalmCredit Loan offers quick and hassle-free access to funds, it’s important to consider the interest rates and fees associated with the loan. Interest rates can vary based on factors such as loan amount and repayment terms. To ensure transparency, PalmCredit clearly outlines all fees and charges upfront, so borrowers can make an informed decision.

Credit scoring and loan eligibility: PalmCredit Loan app utilizes advanced credit scoring algorithms to determine loan eligibility. This means that even individuals with a low credit score can still be considered for a loan. By analyzing various data points, PalmCredit evaluates an applicant’s creditworthiness, enabling more access to funds for those who might otherwise be overlooked by traditional lenders.

Read Also: How to Start a POS Business in Nigeria – The Ultimate Guide

Flexible loan application process

One of the standout features of PalmCredit Loan is its user-friendly loan application process. Here’s a step-by-step guide on how to apply for a PalmCredit Loan:

1. Creating a PalmCredit Account

Before proceeding with the loan application, you need to create an account on the PalmCredit mobile application. This involves providing basic personal information such as your name, email address, and phone number.

2. Providing personal and financial information

Once your account is created, you’ll need to provide additional personal and financial information. This may include details such as your age, employment status, monthly income, and bank account information.

3. Loan application review process

After submitting your application, PalmCredit will review your details and assess your eligibility for a loan. This typically involves evaluating your creditworthiness and verifying the accuracy of the information provided.

PalmCredit Loan Repayment

Efficient loan repayment is crucial to maintaining a healthy financial record and avoiding unnecessary penalties. PalmCredit Loan offers various repayment options to suit individual preferences. Here’s what you need to know:

Loan repayment options: PalmCredit Loan provides borrowers with convenient repayment options. You can choose to repay the loan through automatic deductions from your bank account, mobile money platforms, or manual repayment through the mobile application or designated payment agents.

Late payment penalties and consequences: It’s important to make timely loan repayments to avoid incurring penalties and damaging your credit score. If you miss a loan repayment deadline, PalmCredit may charge late payment penalties, which can accumulate over time. Additionally, frequent defaults may negatively impact your creditworthiness.

Early loan repayment advantages: If you find yourself in a position to repay your PalmCredit Loan before the due date, you can benefit from early loan repayment advantages. Doing so can help you save on interest charges and improve your creditworthiness.

Read Also: QuickCheck Loan App – Loan Apps in Nigeria

PalmCredit Loan Security Measures

Data privacy and security are of utmost importance when dealing with online loan providers. PalmCredit Loan takes several measures to safeguard your personal and financial information. Here are some security features implemented by PalmCredit:

- Secure data encryption to protect sensitive personal information.

- Regular security audits and updates to mitigate potential vulnerabilities.

- Strong authentication protocols to ensure authorized access.

- Compliance with data protection regulations.

Common Myths and Misconceptions about PalmCredit Loan

As with any popular loan provider, there may be myths and misconceptions surrounding PalmCredit Loan. It’s important to address these doubts and separate facts from rumors. Here are some common myths debunked:

Addressing doubts about PalmCredit Loan

Myth: PalmCredit Loan is only for individuals with high credit scores.

Fact: PalmCredit Loan considers individuals with varying credit scores for loan approval.

Myth: PalmCredit Loan app charges hidden fees that increase the cost of borrowing.

Fact: PalmCredit Loan provides transparent information about fees and charges upfront.

Myth: PalmCredit Loan shares personal information with third parties.

Fact: PalmCredit Loan prioritizes data privacy and does not share information without consent.

Alternatives to PalmCredit Loan

While the PalmCredit Loan app offers numerous benefits, it’s always wise to explore alternative personal loan providers. By comparing features and benefits, you can ensure that you make the best decision for your financial needs. Some alternatives to consider include:

- Loan providers with lower interest rates and fees.

- Institutions that offer higher loan amounts.

- Lenders with more flexible repayment terms.

Read Also: PalmPay Login – Digital Banking with PalmPay

Understanding Loan Agreement Terms and Conditions

Before finalizing any loan agreement, it’s essential to understand the terms and conditions in detail. Here are some key elements of a comprehensive loan agreement:

- The loan amount and repayment terms.

- Interest rates and fees.

- Late payment penalties.

- Conditions for early loan repayment.

- Rights and obligations of the borrower and lender.

Conclusion

In conclusion, the PalmCredit Loan app provides a hassle-free and convenient option for individuals in need of quick personal loans. With its user-friendly mobile application, transparent fees, and flexible repayment options, PalmCredit has quickly become a trusted name in the lending industry.

Frequently Asked Questions (FAQs)

- How quickly can I receive a PalmCredit Loan? A: Upon successful loan application approval, funds are generally dispersed within 24 hours.

- Can I apply for a PalmCredit Loan if I have a low credit score? A: Yes, PalmCredit Loan considers individuals with varying credit scores during the loan approval process.

- How does PalmCredit ensure the privacy and security of my personal information? A: PalmCredit implements secure data encryption, regular security audits, and strong authentication protocols to protect your information.

- What happens if I miss a loan repayment deadline? A: Missing a loan repayment deadline may result in late payment penalties and a negative impact on your creditworthiness.

- Can I repay my PalmCredit Loan before the due date? A: Yes, early loan repayment is possible and can be advantageous, leading to interest savings and improved creditworthiness.

- Does PalmCredit Loan charge any hidden fees? A: No, PalmCredit Loan provides transparent information about all fees and charges upfront.