Pocket App is an addition to the fintech drive in Nigeria. And with the advent of smartphones and their widespread use, managing one’s finances has become more convenient than ever before. This article will explore PocketApp by Piggyvest, a revolutionary smartphone application that has completely transformed the way individuals save and invest their money.

Introducing PocketApp by Piggyvest

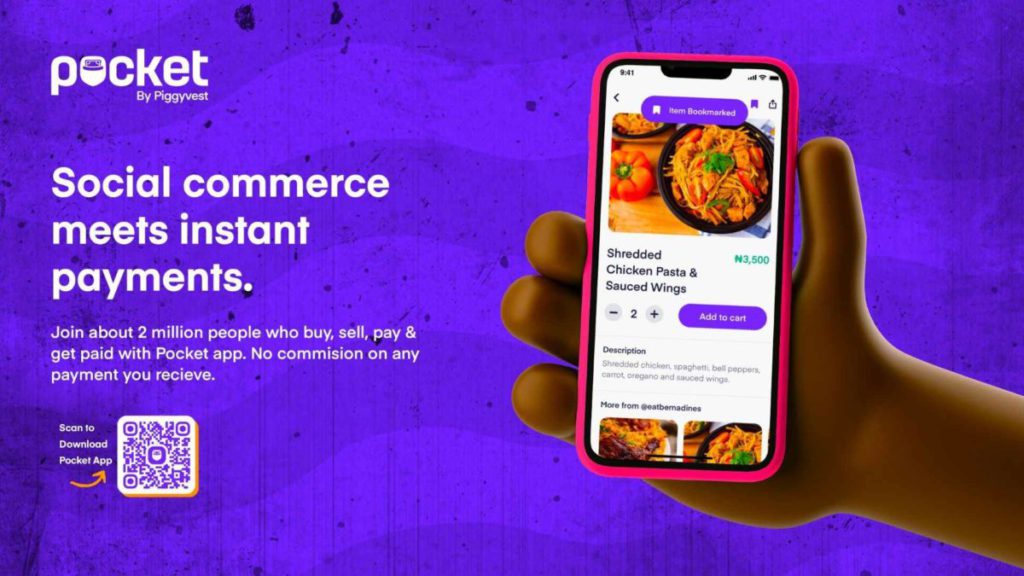

Pocket App, developed by the innovative team at Piggyvest, is an intuitive and user-friendly application. Designed to make personal finance management accessible to everyone. Through its comprehensive range of features, PocketApp empowers users to take control of their finances and achieve their savings and investment goals.

The aim is to provide individuals with a seamless and empowering experience, enabling them to unleash the full potential of personal finance.

The Evolution of PiggyVest

Piggyvest began its journey as a simple savings platform, offering users a secure and convenient way to save money. With a vision to promote a saving culture among individuals, Piggyvest gained popularity for its user-friendly interface and transparent savings options. As more users embraced the platform, the team at Piggyvest saw the opportunity to expand its offerings and cater to a wider range of personal finance needs.

Piggyvest’s transformative shift toward comprehensive financial management

Driven by a desire to provide users with a holistic financial management experience, Piggyvest underwent a transformative shift. This shift led to the development of PocketApp, which combines the core savings functionality that Piggyvest is known for with a host of new features and capabilities.

With PocketApp, users not only have access to savings options but also gain insight into various investment opportunities, enabling them to unlock the full potential of their money.

Read Also: FairMoney Loan App Download

Understanding Pocket App | A Closer Look

PocketApp boasts a user-friendly interface that ensures a seamless experience for users of all levels of financial literacy. The intuitive layout and navigation make it easy to access various features and functionalities, enabling users to effortlessly manage their finances. Whether you are a novice or an experienced investor, PocketApp guarantees a smooth and hassle-free interface.

Key features and functionalities

- Goal-based savings

PocketApp allows users to set specific financial goals, whether it be saving for a dream vacation or building an emergency fund. By defining clear objectives, individuals can track their progress and stay motivated on their financial journey. This goal-based approach adds a level of excitement and focus to saving, resulting in more successful outcomes.

- Flexible investment options

In addition to traditional savings accounts, PocketApp offers a range of investment options tailored to individual risk profiles and financial objectives. From treasury bills and bonds to stocks and real estate, users have the freedom to choose investments that align with their preferences and long-term goals.

Read Also: PiggyVest Login – Save with PiggyVest

- Automated wealth management

PocketApp simplifies wealth management by automating certain processes, such as scheduling regular savings. By setting up automatic deductions from your income, you can effortlessly build your savings over time. This feature ensures that you stay committed to your financial goals without the need for constant manual intervention.

Seamless User Experience

Sign-up process and account setup:

Getting started with PocketApp is quick and straightforward. Users can easily download the application from their preferred app store and follow the simple sign-up process. Once registered, users are guided through the account setup, where they can personalize their financial journey according to their preferences.

Personalizing your PocketApp experience

- Setting financial goals

Upon account setup, users are prompted to set financial goals using the goal-based savings feature. This step encourages individuals to define specific objectives, such as saving for education or planning for retirement. By personalizing their goals, users can tailor their PocketApp experience to meet their unique financial aspirations.

- Customizing automatic savings

PocketApp allows users to customize their automatic savings by setting their desired monthly contribution amounts. This flexibility ensures that individuals can build their savings at a pace that suits their financial situation. Whether you prefer to save a fixed amount or a percentage of your income, PocketApp can accommodate your preferences.

Read Also: How to Start a POS Business in Nigeria – The Ultimate Guide

Accelerating Savings with Pocket App

One of the most powerful features of PocketApp is its ability to enable recurring savings. By regularly deducting a predetermined amount from your income, PocketApp ensures consistent contributions to your savings account. This approach eliminates the temptation to spend money impulsively and allows individuals to consistently grow their financial reserves.

Smart features to boost savings

- PiggyPoints: Earning rewards for consistent savings

PocketApp rewards users for their consistent savings efforts through a unique feature called PiggyPoints. By saving regularly, users accumulate PiggyPoints, which can be redeemed for various rewards or used to offset transaction fees. This gamified approach to savings encourages individuals to maintain a disciplined saving habit.

- Group Saving Challenge: Cultivating saving habits with friends

PocketApp offers a group saving challenge feature that enables users to join saving groups with friends, family, or colleagues. This feature fosters a sense of community and accountability, as group members work together to achieve their collective savings goals. Participating in group challenges can be an excellent motivator for individuals who thrive in a collaborative environment.

Exploring Investment Opportunities

PocketApp goes beyond traditional savings accounts and offers users a diverse range of investment opportunities. Whether you’re a risk-averse investor or someone seeking higher returns, PocketApp has investment options suitable for different risk profiles and financial goals.

Deep dive into PocketApp investment vehicles

- Treasury Bills and Bonds

For individuals looking for relatively low-risk investment options, PocketApp offers the opportunity to invest in treasury bills and bonds. These government-backed securities provide stable returns over a fixed period and are ideal for conservative investors seeking capital preservation.

- Stocks and Real Estate

For those willing to take on a higher level of risk, PocketApp allows users to invest in stocks and real estate. Through strategic partnerships with reputable brokers and real estate developers, PocketApp provides users with access to these potentially high-growth investment avenues. This diversification of investment options widens the horizon for users and encourages them to explore a broader range of earning potentials.

- Agriculture and Transport

In addition to traditional investment options, PocketApp also offers unique investment opportunities in sectors such as agriculture and transport. These alternatives provide users with exposure to innovative investment models, allowing them to support the development of these industries while potentially earning attractive returns.

Read Also: QuickCheck Loan App – Loan Apps in Nigeria

Risk Mitigation and Security Measures

PocketApp prioritizes the safety of users’ funds and personal information. As a fintech platform, it adheres to stringent security protocols to safeguard against unauthorized access and fraudulent activities. The application utilizes advanced encryption techniques, ensuring that sensitive data remains secure throughout every financial transaction.

PocketApp’s robust security infrastructure

PocketApp is supported by a robust security infrastructure consisting of secure servers, multi-factor authentication, and regular security audits. These measures ensure that users can transact with confidence, knowing that stringent security measures are in place to protect their financial well-being.

Empowering Users through Financial Literacy

PocketApp recognizes the importance of financial literacy and aims to equip users with the knowledge needed to make informed financial decisions. The application provides access to a wide range of educational resources, including articles, tutorials, and interactive tools. By empowering users with financial knowledge, PocketApp encourages individuals to take charge of their financial future.

Promoting financial literacy initiatives

Piggyvest, the driving force behind PocketApp, actively participates in financial literacy initiatives to support its users and the wider community. Through partnerships with educational institutions, financial experts, and industry professionals, Piggyvest strives to create awareness and educate individuals about personal finance management.

Frequently Asked Questions (FAQs)

How do I set up my Pocket App account?

Setting up your PocketApp account is a straightforward process. Simply download the application from your app store, follow the sign-up instructions, and complete the account setup. Once you’ve successfully registered, you can begin exploring the features and functionalities of PocketApp.

Are my funds safe and secure on PocketApp?

Yes, PocketApp prioritizes the safety and security of users’ funds. The application utilizes advanced encryption techniques and adheres to strict security protocols to ensure that your funds remain secure. Additionally, PocketApp’s robust security infrastructure provides an added layer of protection against unauthorized access.

What are the available investment options?

PocketApp offers a wide range of investment options, including treasury bills, bonds, stocks, real estate, agriculture, and transport. These options cater to different risk profiles and financial objectives, enabling users to diversify their investment portfolio and potentially earn attractive returns.

How does PocketApp differ from other financial apps?

PocketApp sets itself apart from other financial apps by offering a comprehensive suite of features that go beyond traditional savings accounts. With its goal-based savings, flexible investment options, and automated wealth management, PocketApp provides users with a holistic financial management experience.

How can I maximize my savings using Pocket App?

To maximize your savings using PocketApp, take advantage of the recurring savings feature, which allows you to automate regular contributions to your savings account. Additionally, consider joining group saving challenges to cultivate a culture of saving and earn rewards through PiggyPoints. By setting financial goals and customizing your savings preferences, you can stay motivated on your savings journey.

Read Also: PalmPay Login – Digital Banking with PalmPay

Summary

The potential of the PocketApp by Piggyvest for personal finance management offers a transformative tool that empowers users to save, invest, and grow their wealth systematically. This comprehensive guide reveals the key functionalities, user-friendly interface, investment opportunities, risk mitigation measures, and the app’s social impact.

PocketApp is indeed revolutionizing how individuals approach personal financial management.